Leave Your Message

-

Phone

-

E-mail

-

Whatsapp

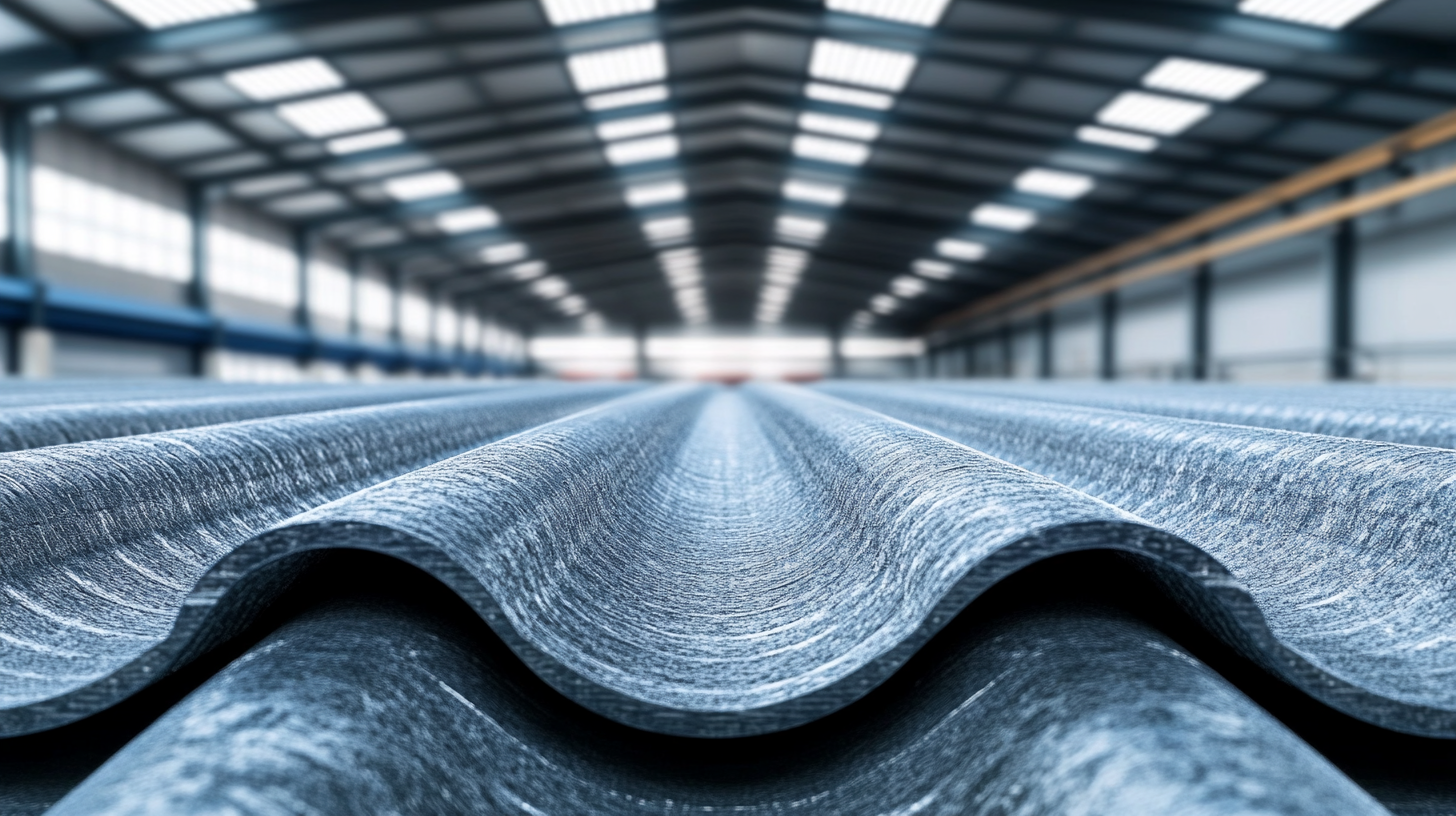

In the face of escalating tariff challenges between the United States and China, the resilience of China's manufacturing sector is remarkably evident. As companies adapt to an increasingly complex trade landscape, innovation and quality remain at the forefront of their strategies. Notably, the demand for specialized products, such as Soundproof Roof Sheets, has surged, showcasing how local manufacturers are not only surviving but thriving amidst adversity. These advanced soundproof solutions are critical for various applications, offering vital noise reduction that meets the needs of both residential and commercial spaces. As we explore this topic, we will delve into the factors contributing to China's manufacturing growth and the ways in which soundproof technologies illustrate the industry's adaptability and forward-thinking approach during these challenging times.

In the face of significant tariff challenges imposed by the United States, China's manufacturing sector has demonstrated remarkable resilience. Despite the hurdles, the industry has not only stabilized but is also evolving through innovation and strategic adaptation. With a focus on high-quality production and efficient supply chains, manufacturers are finding ways to minimize the impact of tariffs and maintain their competitive edge.

One area where this adaptability is particularly evident is in the production of soundproof roof sheets. As the demand for noise reduction solutions increases globally, Chinese manufacturers have been quick to respond with advanced technology and materials. By leveraging their manufacturing expertise, they are producing high-performance soundproof roofing that meets international standards, thus attracting a diverse clientele that includes both domestic and international markets. This ability to pivot and innovate is a testament to China's commitment to sustaining its manufacturing prowess, even in challenging times.

Amidst the ongoing challenges posed by US-China tariffs, Chinese manufacturers are increasingly adopting strategic approaches to maintain their competitiveness in the global market. From enhancing operational efficiencies to diversifying supply chains, these strategies are vital for navigating the complexities of trade barriers. One key tactic involves optimizing production processes, allowing manufacturers to lower costs and improve product quality. This not only enhances their competitiveness but also enables them to offer innovative solutions, such as advanced soundproof roof sheet options that meet growing market demands.

In addition to operational improvements, Chinese manufacturers are focusing on building strong relationships with international partners. By fostering collaborations and exploring new markets, they can mitigate the impact of tariffs on their export revenues. Emphasizing the importance of adaptability, companies are also investing in research and development to create products that meet local regulations and consumer preferences in various markets. These proactive measures ensure that manufacturers not only survive but thrive in a challenging trade environment, making significant strides in sectors like construction materials where demand for specialized products like soundproof roofing is on the rise.

In the face of increasing tariffs and trade tensions between the US and China, the Chinese manufacturing sector continues to demonstrate resilience, particularly in the production of innovative soundproof roof sheet solutions. According to a report by MarketsandMarkets, the global soundproofing materials market is expected to grow from USD 37.84 billion in 2020 to USD 49.78 billion by 2025, highlighting a significant demand for effective soundproofing technologies in both residential and industrial applications. This growth is largely driven by the increasing focus on reducing noise pollution and enhancing acoustic comfort in urban environments.

To thrive in this competitive landscape, manufacturers are investing in advanced technologies and sustainable materials that not only meet client specifications but also adhere to environmental regulations. Tips for choosing the best soundproof roof sheets include assessing the noise reduction coefficient (NRC), selecting materials that are lightweight yet durable, and considering eco-friendly options such as recycled composite materials. The adoption of innovative manufacturing processes, such as modular construction, also plays a critical role in enhancing the efficiency and effectiveness of soundproof roof solutions.

Furthermore, the use of advanced acoustic insulation in these roof sheets can significantly improve noise control in commercial buildings, leading to better occupant satisfaction and wellbeing. According to the Environmental Protection Agency, appropriate soundproofing can reduce stress and increase productivity in workplaces by as much as 15%. By prioritizing innovative soundproof solutions, manufacturers in China are not only addressing current market demands but also setting a benchmark for quality and performance in the industry.

| Parameter | Value |

|---|---|

| Manufacturing Growth Rate (2023) | 6.5% |

| Export Value of Soundproof Materials (2022) | $1.2 Billion |

| Average Price of Soundproof Roof Sheets (2023) | $25/sheet |

| Main Export Markets | USA, Germany, Japan |

| Number of Manufacturers in China | 300+ |

| Market Share of Top 5 Manufacturers | 60% |

| Year-on-Year Growth in Soundproof Material Sales | 8% |

The U.S.-China trade tensions have significantly reshaped global supply chains, with the imposition of tariffs creating a cascading effect across various sectors. According to a recent report by the Institute for Supply Management, nearly 75% of manufacturing companies in the U.S. have reported disruptions due to the tariff policies, prompting many to reconsider their sourcing strategies. As firms seek to diversify away from reliance on Chinese production, they find themselves in a critical transition phase, often leading to increased costs and complicated logistics.

In light of the recent tariff pause announced by U.S. authorities, some businesses are ramping up imports from China, yet experts warn that this surge may come with a trade-off. Market analysts indicate that while a temporary reduction in tariffs may alleviate immediate shipping pressures, it also exacerbates uncertainties, as companies are grappling with higher prices and potential shortages on retail shelves. The Global Supply Chain Survey highlights that 54% of importers anticipate further price increases, which could lead to a more complicated landscape as firms attempt to balance cost against the need for stable inventory levels. This intricate dynamic underscores the ongoing challenges posed by U.S.-China relations and the persistent quest for efficient supply chain management.

This bar chart illustrates the annual manufacturing growth rates in China from 2018 to 2022, highlighting the resilience of the manufacturing sector amidst US-China trade tensions and tariff challenges.

As we dive into the future prospects for manufacturing growth amidst ongoing U.S.-China trade tensions, it's vital to acknowledge the evolving landscape and the challenges that lie ahead. Despite recent rebounds in manufacturing activity, the uncertainty created by tariffs and fluctuating global demand looms large. Companies may find themselves navigating a complex web of trade policies that could affect their operational efficiency and profitability.

Tips for thriving in this environment include diversifying supply chains and exploring partnerships in emerging markets. Manufacturers should consider investing in innovative solutions, such as soundproof roof sheet technologies, which not only enhance product offerings but also cater to increasing consumer demand for quality and sustainability.

Moreover, staying informed about geopolitical shifts and actively engaging in discussions about trade policies can empower manufacturers to adapt to challenges effectively. By harnessing data and trends from both the U.S. and China, businesses can position themselves strategically to capture new opportunities and mitigate risks in a changing global economy.